Bank Statement of The Bank of America

Your Bank of America statement arrives, and suddenly, you’re staring at a list of charges that look more like secret codes—“POS 0456XM” and “SVC FEE”

What do they even mean? Understanding your bank statement isn’t just about reading numbers; it’s about uncovering spending patterns, catching hidden fees, and gaining control over your finances.

This guide breaks down every section. By the end, you’ll read statements like a librarian reads indexes—methodically, critically, and with mild suspicion. Ready to turn confusion into actionable insight?

Let’s begin.

Overview of Bank of America Bank Statements

A bank statement is an official document issued by Bank of America that summarizes all transactions within a specific account over a set period, typically one month. It includes deposits, withdrawals, purchases, fees, and interest earned, giving you a comprehensive view of your financial activity.

- Purpose and Importance: Bank statements help you track spending, verify transactions, and detect unauthorized activity. They are also essential for budgeting, financial planning, and maintaining accurate records for tax purposes.

- Accountability and Transparency: By regularly reviewing your bank statement, you gain greater control over your finances, ensuring accuracy and accountability in your spending and saving habits.

Statement Availability

Bank of America provides flexible options for accessing your statements, making it easy to stay organized and informed about your financial activity.

- Monthly Issuance: Statements are issued monthly, typically at the end of each billing cycle, summarizing all transactions, fees, and interest earned during that period.

- Options for Receiving Statements:

- Paper Statements: Delivered by mail for those who prefer physical copies. However, Bank of America may charge a fee for paper statements, depending on your account type.

- Electronic Statements (e-Statements): Available online through Bank of America’s online banking platform or mobile app. E-statements are eco-friendly, secure, and can be accessed anytime for up to 24 months.

Tip: Opting for e-statements not only reduces paper clutter but also enhances security by minimizing the risk of mail theft.

Key Components of a Bank of America Bank Statement

Understanding each section of the statement is crucial for maintaining accurate financial records and ensuring no unauthorized activity goes unnoticed. Here’s a breakdown of the key components and what they mean for your financial health.

Personal Information

Your bank statement includes essential personal details to ensure that the document is secure and accurate. Here’s what to check:

- Name and Address: Located at the top of the statement, this information confirms that the statement is yours. It’s crucial to verify your name and address for accuracy, especially if you’ve recently moved.

- Account Number: Only the last four digits of your account number are displayed to protect your privacy. This partial account number helps you identify which account the statement corresponds to without compromising your security.

Statement Period

The statement period is the timeframe that the statement covers, summarizing all financial activity within that period. Understanding this section is essential for accurate tracking and budgeting.

- Definition: The statement period shows the start and end dates of the billing cycle. For example, it could span from the 15th of one month to the 14th of the next, meaning it doesn’t always align with the calendar month.

Tip: If you’re budgeting monthly, make sure to adjust for statement periods that don’t align perfectly with the calendar month.

Account Summary

The account summary provides an overview of your account’s financial activity, giving you a clear snapshot of your financial health for the statement period. Here’s what it includes:

- Opening Balance: The account balance at the start of the statement period. This number should match the closing balance from the previous statement.

- Total Deposits and Credits: A total of all incoming funds, including direct deposits, transfers, and cash deposits.

- Total Withdrawals and Debits: A total of all outgoing funds, including purchases, bill payments, ATM withdrawals, and automatic deductions.

- Closing Balance: The balance at the end of the statement period, calculated by adding total deposits and subtracting total withdrawals from the opening balance.

- Accrued Interest: For interest-bearing accounts, the statement displays the interest earned during the statement period.

Transaction Details

This section provides a chronological list of all transactions made within the statement period, allowing you to track your spending and verify each entry for accuracy.

- Deposits (Credits): This includes all incoming funds, such as:

- Direct Deposits: Salary payments, government benefits, or any other direct credits to your account.

- Transfers: Funds transferred from other accounts or received from third parties.

- Cash Deposits: Physical cash deposited at an ATM or branch.

- Withdrawals (Debits): This includes all outgoing funds, such as:

- Payments: Purchases made with your debit card, online payments, or checks.

- ATM Withdrawals: Cash withdrawals from ATMs, both in-network and out-of-network.

- Automatic Deductions: Recurring payments for bills, subscriptions, or loan payments.

- Detailed Descriptions: Each transaction entry includes:

- Date and Amount: When the transaction occurred and the amount deducted or credited.

- Merchant Name: The name of the merchant or payee, helping you identify the nature of the transaction.

- Transaction Type: Labeled as a purchase, bill payment, transfer, or withdrawal.

Fees and Charges

Bank of America clearly lists all fees and charges applied to your account during the statement period. Here’s what to look for:

- Maintenance Fees: Monthly fees for account maintenance, which can often be waived if certain requirements are met (e.g., maintaining a minimum balance or setting up direct deposit).

- Transaction Fees: Charges for specific transactions, such as using out-of-network ATMs or wire transfers.

- Penalty Charges: Fees for overdrafts, insufficient funds, or exceeding withdrawal limits.

Tip: Check if you qualify for Bank of America’s Preferred Rewards program, which offers fee waivers and other benefits.

Interest Earned

For interest-bearing accounts, Bank of America displays the interest earned during the statement period. Understanding how this works can help you maximize your savings.

- Accrued Interest: Shows the total interest earned on your balance during the statement period. This is usually calculated based on your daily balance and the annual percentage yield (APY).

- Interest Rate Details: Some statements include the interest rate or APY applied to your account, helping you compare returns with other savings or investment options.

How to Access and Download Bank of America Bank Statements

Bank of America’s online banking platform offers a secure and straightforward way to access your bank statements. Here’s how to navigate the system efficiently:

Access via Online Banking

- Log In: Visit www.bankofamerica.com and sign in using your User ID and Password. For added security, you may be prompted to verify your identity with a one-time code.

- Navigate to e-Statements: Once logged in, go to the ‘Accounts’ tab and select the account you want to view. Click on the ‘Statements & Documents’ option.

- Select Statement Period: Choose the statement period you wish to view. Bank of America provides up to 24 months of digital statements.

- View and Download: Click on the statement to view it online. To download, select ‘Download PDF’ for a digital copy. PDF statements are formatted just like paper statements, making them suitable for official records and financial documentation.

Using the Mobile App

If you prefer managing your finances on the go, Bank of America’s mobile app provides quick and convenient access to your statements. Here’s how to do it:

- Open the App: Launch the Bank of America mobile app and securely sign in using your User ID, Password, or biometric authentication (Face ID or Fingerprint Login).

- Select Account: From the dashboard, tap on the account for which you want to view statements.

- View Statements: Scroll down and tap on ‘Statements & Documents’. You’ll see a list of available statements organized by month.

- Download or Share: Tap on a statement to view it as a PDF. You can download it to your device or share it via email for record-keeping or tax preparation.

Tip: Use the mobile app to access your statements anytime, anywhere, making financial management more flexible and efficient.

Download Options

Once you’ve accessed your statements, Bank of America provides multiple download options to help you organize and analyze your financial data more effectively.

- Downloading as PDFs: PDF statements are the default format for downloading, preserving the original layout for official records and documentation. They are also ideal for printing or archiving.

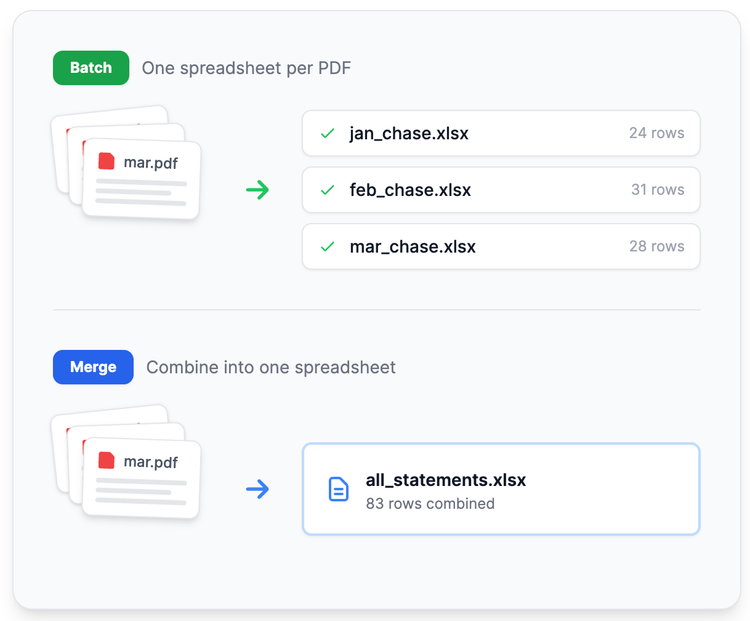

- Converting PDF Statements to Excel or CSV: To better track expenses or create detailed financial reports, you may need to convert PDF statements into a more editable format:

- Using Convert My Bank Statement: This tool easily converts PDF bank statements into Excel or CSV files, allowing you to organize transactions, categorize expenses, and analyze spending patterns more efficiently.

- Manual Conversion: Alternatively, you can use online converters or software like Adobe Acrobat to export the PDF as an Excel file. However, Convert My Bank Statement offers more accurate conversions and organized data output.

Understanding and Analyzing Transactions

From deposits to fees, knowing how to read your statement helps you verify accuracy, track spending, and even save on fees. Here’s how to break down each section effectively.

Deposits

Deposits are credits to your account, increasing your balance. It’s important to verify each deposit for accuracy to ensure no funds are missing or duplicated. Here’s what to look for:

- Types of Deposits:

- Direct Deposits: Automatic credits from employers, government benefits, or other recurring sources. These are typically labeled as “DIR DEP” or “ACH Credit.”

- Transfers: Money transferred from another Bank of America account or external accounts linked to your profile.

- Other Credits: Cash deposits made at ATMs or branches, check deposits, or refunds from merchants.

- Tips for Verifying Accuracy:

- Cross-Check Dates: Make sure the deposit dates on your statement match the payment dates from the source (e.g., paycheck dates).

- Amount Verification: Double-check deposit amounts to ensure they are accurate. For recurring deposits, look for consistency in the amounts credited.

- Notification Alerts: Set up alerts on the Bank of America mobile app to receive notifications when deposits are credited, helping you monitor transactions in real time.

Withdrawals and Payments

Withdrawals and payments are debits that decrease your account balance. Tracking these expenses helps you manage spending, avoid overdrafts, and identify unauthorized transactions. Here’s how to analyze them:

- Types of Withdrawals and Payments:

- ATM Withdrawals: Cash withdrawals made from ATMs, including in-network (Bank of America) and out-of-network ATMs. Out-of-network withdrawals may include additional fees.

- Bill Payments: Payments made through online banking or automatic bill pay, often labeled as “ACH Debit” or “Bill Pay.” These include utility bills, subscriptions, and loan payments.

- Automatic Debits: Recurring payments set up for subscriptions, memberships, or installment loans. These are typically labeled with the merchant’s name and a recurring payment indicator.

- Point of Sale (POS) Purchases: Transactions made using your debit card at physical stores or online merchants, often labeled with the merchant’s name and location.

- Reviewing for Unauthorized Transactions or Errors:

- Transaction Descriptions: Carefully read the descriptions and merchant names to ensure they match your purchases. Watch out for unfamiliar names or locations, which may indicate unauthorized transactions.

- Amount Verification: Check each amount against your receipts or payment confirmations to ensure accuracy. Look for duplicate charges or incorrect amounts.

- Dispute Process: If you identify an unauthorized transaction or error, contact Bank of America’s customer service or use the dispute option within the mobile app to resolve the issue promptly.

Tip: Reviewing your withdrawals regularly helps you track spending habits, prevent overdrafts, and catch fraudulent activity early.

Fees and Charges

Bank of America charges various fees depending on your account type and usage. Understanding these fees allows you to minimize costs and avoid unnecessary charges. Here’s how to identify and manage them:

- Types of Fees:

- Monthly Maintenance Fees: Recurring fees for maintaining your account, which can often be waived by meeting certain requirements (e.g., maintaining a minimum balance or setting up direct deposits).

- ATM Fees: Charges for using out-of-network ATMs, which may include both Bank of America’s fee and the ATM operator’s fee.

- Overdraft Fees: Fees for insufficient funds or overdrafts, which can be avoided by setting up Balance Connect® overdraft protection.

- Transaction Fees: Fees for specific transactions, such as wire transfers, stop payments, or foreign transactions.

Interest Earned and Balance Calculation

For interest-bearing accounts, understanding how interest is calculated helps you maximize your earnings. Accurate balance calculations also ensure financial accountability. Here’s how to interpret these sections:

Accrued Interest

Displayed on statements for savings accounts, money market accounts, and some checking accounts. Interest is calculated based on your daily balance and the account’s annual percentage yield (APY).

Compounding Frequency

Bank of America typically compounds interest monthly, which means interest earned is added to the principal balance, earning interest on itself.

Interest Rates

Interest rates are displayed as APY, reflecting the annualized return on your balance. Check your statement to see if you’re getting the most competitive rate.

Digital Statements vs. Paper Statements

Choosing between digital statements (e-Statements) and paper statements depends on your lifestyle, security needs, and environmental values. Here’s a quick, scannable comparison to help you decide:

Best Practices for Managing Bank of America Bank Statements

Effectively managing your Bank of America statements helps you stay organized, avoid errors, and achieve your financial goals. Here’s how to do it efficiently:

- Regular Review and Reconciliation: Review your statements monthly to verify all transactions and detect unauthorized charges. Reconcile them with your expense trackers or budgeting apps for accuracy.

- Record Keeping and Organization: Store e-statements securely on your computer or cloud storage, organized by year and account type. Keep paper statements in a locked file cabinet, especially for tax purposes.

- Handling Discrepancies and Disputes: Report any discrepancies, such as unauthorized charges or errors, to Bank of America immediately. You can dispute transactions through online banking, the mobile app, or customer service.

- Budgeting and Financial Planning: Use your statements to track spending patterns, identify savings opportunities, and adjust your budget. This helps you set realistic financial goals and control your expenses.

How to Convert Bank Statements

Converting PDF bank statements to Excel or CSV is simple with the right tools. Use reliable tools like Convert My Bank Statement to accurately convert PDF statements into organized Excel or CSV files. These tools maintain transaction details and category breakdowns for better data management.

Here’s how to do it:

- Upload the PDF: Select and upload your Bank of America statement to the conversion tool.

- Choose Format: Select Excel (.xlsx) or CSV (.csv) as the output format.

- Convert and Download: Click on ‘Convert’ and download the file. The data will be organized in a spreadsheet format, ready for analysis.

Conclusion

Understanding your Bank of America statement is key to managing your finances effectively. By regularly reviewing transactions, reconciling records, and analyzing spending patterns, you can catch errors, avoid unnecessary fees, and make informed financial decisions.

Whether you’re budgeting, saving, or preparing for taxes, mastering your statement gives you better control over your financial life.

To simplify this process, use Convert My Bank Statement. It easily converts PDF statements into Excel or CSV files, allowing you to categorize expenses and analyze financial data with ease.

With the right strategy and tools, your Bank of America statement becomes more than just a record—it becomes a powerful financial planning resource.

FAQs

1. Can I download my Bank of America statements in Excel or CSV format directly?

No, Bank of America only allows statements to be downloaded as PDFs. However, you can easily convert them into Excel or CSV formats using tools like Convert My Bank Statement, which ensures accurate data organization for better financial tracking.

2. How far back can I access my Bank of America statements online?

Bank of America provides up to 24 months of digital statements through its online banking platform and mobile app. For older statements, you may need to request them directly from customer service or visit a branch.

3. How can I use my bank statements for budgeting and financial planning?

Your Bank of America statements provide a detailed overview of your income, expenses, and spending habits. By converting your statements into Excel or CSV using Convert My Bank Statement, you can categorize expenses, calculate totals, and create personalized budgets to achieve your financial goals.